Chronicle of a Death Foretold

Drizly is to be eliminated 3 years after being acquired by Uber for $1.1bn. But was it really a surprise?

E-commerce alcohol sales boomed during the pandemic, and the channel’s value share of ‘total beverage alcohol’ has risen from 2.1% in 2018 to 3.7% in 2021. Drizly, North America’s leading on-demand alcohol marketplace, was one of the big winners with sales increasing threefold in 2020 alone[1].

Uber firstly announced Drizly’s purchase in early 2021. Uber’s ridesharing revenue had been dramatically impacted by restrictions imposed by the pandemic, and the company paid $1.1 billion to fully acquire the successful drinks platform…

…only to announce that it will eliminate Drizly in March 2024.

Why?

Was the issue…

1. The diminishing appeal of alcohol e-commerce?

2. The poor strategic fit between Drizly and Uber?

3. The evolving strategy of Uber Eats?

All (or none) of the above?

And, very importantly, what is the impact of this move on alcohol brands?

"According to recent research, over 50% of online alcohol buyers expect delivery to happen within the next two hours of ordering, maximum on the same day”

- 1. WAS THE ISSUE… THE DIMINISHING APPEAL OF ALCOHOL E-COMMERCE?

From a global perspective, the alcohol e-commerce channel is likely to continue growing – albeit at lower rates – and is expected to stabilise at around 4% to 4.5% value of total beverage alcohol by 2027, equivalent to a massive US$40 billion in sales[2].

China and the US will drive much of the channel’s growth, in both cases powered by the Spirits category. In South America, investments in ‘on-demand’ (quick delivery) infrastructure – in many markets promoted by breweries such as AB Inbev – are increasing the Beer category share out of total sales. Brazil is expected to overtake Japan to become the fourth-largest e-commerce value market[3].

Therefore, e-commerce remains a key channel, and ‘on-demand’ seems to have an increasingly important role to play. According to recent research, over 50% of online alcohol buyers expect delivery to happen within the next two hours of ordering, maximum on the same day[4].

In brief, alcohol e-commerce remains appealing and is evolving. However, competitive pressure is growing and therefore establishing strong ‘top-of-mind platforms’ becomes crucial. Focus is more valuable than distraction.

- 2. WAS THE ISSUE… THE POOR STRATEGIC FIT BETWEEN DRIZLY AND UBER?

Drizly was founded in 2012 to become North America’s leading on-demand alcohol marketplace. Some of the key reasons behind its success were an infrastructure that seamlessly addressed age verification, and a system designed to effectively deal with the highly complex US three-tier regulation[5].

When Drizly was acquired in 2021, Uber claimed it would “expand its geographic presence into Uber’s global footprint in the years ahead”. However, this did not happen: Drizly remained North America focused. From a consumer interface perspective, Drizly continued operating as a standalone platform, and in parallel it was also featured within the Uber Eats app.

Meanwhile, post-acquisition, the team from Drizly had a challenging time. It had to deal with security breaches which compromised the data of 2.5 million consumers, and struggled to keep post-pandemic growth momentum, having to rely on heavy promotions and discounts to get people back into the app. Over time, many Drizly executives were transferred to the larger Uber teams and over 100 employees were made redundant last year.

Perhaps the real intent of Uber was revealed in an early statement, where it was claimed that Drizly “will be eventually integrated”. Has Drizly’s disappearance always been on the cards?

- 3. WAS THE ISSUE… THE EVOLVING UBER EATS STRATEGY?

Uber Eats has gone from restaurant food delivery to much more. Its ambition is to become the one-stop-shop, the one single app for ‘almost anything’: food, groceries, prescriptions, alcohol, and so on.

Rather than keeping multiple businesses, Uber’s approach is to purchase, incorporate and finally ‘annihilate’ them. This was the case with other platforms acquired by Uber such as Cornershop (Latin American delivery start-up) and Postmates (US independent food delivery service).

Alcohol is an important part of their strategy. Whereas perishable food is renowned for tight margins and requires immediate delivery, alcohol allows for boosting basket size as well as grouping larger orders for drop off over a few hours. DoorDash, one of Uber Eats key competitors in the US, estimated that “adding alcohol may increase restaurant and grocers’ average customer order values by up to 30% and convenience stores by over 50%”[6]. Recent partnerships with specialists such as Majestic in the UK evidences Uber Eats interest in the delivery of alcohol beverages, and the company reports alcohol sales on Uber Eats more than doubled in the last year[7].

Uber believes it can more quickly grow the basket size of Uber Eats by offering alcohol in just one place, rather than through both Uber Eats and Drizly apps. Moreover, Uber Eats has a much larger number of users than Drizly (most of whom have accounts on both platforms), and consumer migration towards Uber Eats is expected to be done pretty much automatically.

In Summary

The disappearance of Drizly doesn’t come as a surprise. It reflects a combination of environment changes and increased competitive pressure, difficulties encountered by Drizly, and the ‘centralising’ strategy pursued by Uber Eats.

Although Drizly was likely at its peak valuation when it was acquired, it fulfilled its mission to grant Uber Eats access to its US retail network access, capabilities and critical mass in alcohol beverages e-commerce – important for the improvement of basket size and profitability. Investors may also appreciate Uber’s focus behind a single brand.

WHAT ARE THE CONSIDERATIONS AND OPPORTUNITIES FOR DRINKS BUSINESSES?

- Will consumers smoothly transfer from Drizly to Uber Eats? Or will they prefer more lifestyle led, gifting, specialised drinks platforms (such as ReserveBar, Minibar or Whisky Exchange), which may have attracted them to Drizly in the first place? What can brands do to support, thrive and stand out in those specialised online retailers?

- Does the disappearance of Drizly enhance the appeal of DTC for premium alcohol brands?

- As Uber Eats becomes ‘for almost anything’, how do we expect retailers such as Amazon to react?

- Under the Uber Eats’ strategy, will the combined sales of Food with Alcoholic Drinks become even more relevant? Does that offer more opportunities for alcohol drinks to partner with restaurant chains and/or food brands? Does that bring new opportunities for partnerships with Uber Eats?

- Will consolidation under less platforms reduce the power of merchants – and brands? How can they prepare, or potentially capitalise on the changes?

Sylvia Lago, Head of Strategy at Drink Works.

Please get in touch to discuss further: sylvia@drinkworks.co.uk

[1] IWSR Drinks Analysis, December 2023; www.forbes.com, January 2024

[2] IWSR Drinks Analysis, December 2023

[3] IWSR Drinks Analysis, December 2023

[4] Uber Direct Report: The New Brand Builder, July 2023

[5] www.forbes.com, February 2021

[6] about.doordash.com, March 2022

[7] www.thespiritsbusiness.com, January 2024

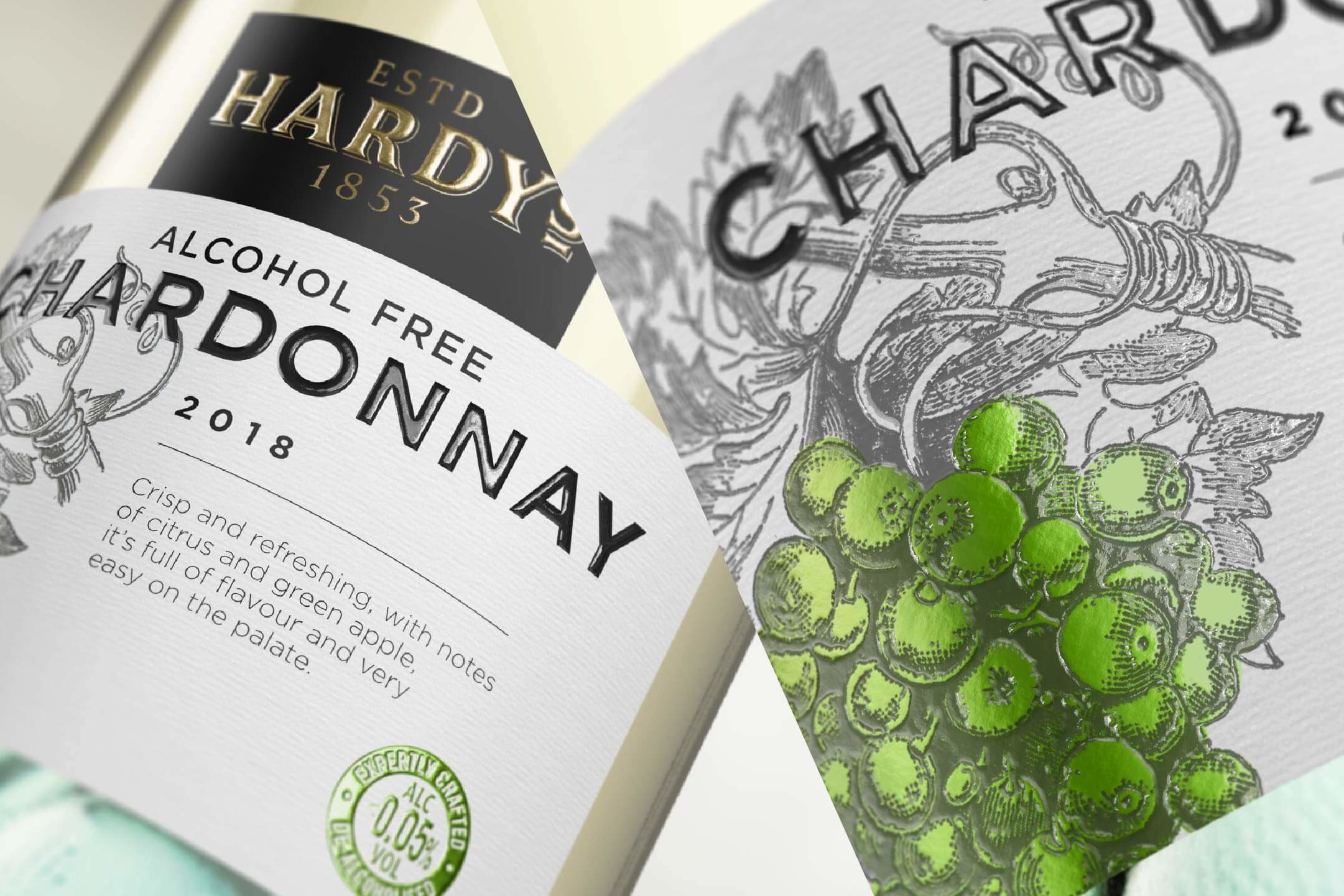

Hardys' first alcohol free Chardonnay

Accolade Wines is bolstering its presence in the growing no and low alcohol category with Hardys’ first alcohol free wine variant Hardys Alcohol-Free Chardonnay, for which Drink Works created the packaging design and tone of voice.

Hardys Alcohol Free Chardonnay is a crisp and refreshing offering, with notes of citrus and green apple. The new product, launched 1st of April 2019, came after Accolade identified an opportunity to corner the growing no and low alcohol sector by capitalising on its Hardys brand positioning as the number one UK wine brand.

"The alcohol free wine category represents a growing £17m profit opportunity for the trade"

— David White, Marketing Director at Accolade Wines

Drink Works was tasked with helping Hardys take leadership in the no and low alcohol space and drive incremental volume and value for the brand – achieved through a bold and authentic design that drives purchase at point of sale. The design was informed by research into the alcohol free category by Drink Works’ strategy team and our remit also included developing the new product’s tone of voice and brand design.

The creative focuses on craft and reassurance, and the design is closely aligned to the traditional wine category, ensuring consistency between the alcohol and alcohol free Hardys variants. It is the brand’s first no alcohol style.

David White, marketing director at Accolade Wines, says: “The alcohol free wine category represents a growing £17m profit opportunity for the trade and Hardys Alcohol Free is perfect to help capitalise on this trend. It offers important wine cues, such as grape style and flavour notes, and strong consumer confidence in the Hardys brand will help to drive purchase on occasions when consumers might be seeking an alternative to alcohol.”

Leyton Hardwick, creative director and founder at Drink Works, adds that “we knew there was an opportunity for a trusted company like Accolade to make a real impact in the no and low alcohol space, especially with a beverage as distinctive as Hardys Alcohol Free Chardonnay. Our creative concept will help attract new audiences to the category, by relying on cues of craft and reassurance as well ensuring visual consistency in line with the Hardys parent brand.”